Latest Articles

The Significance Of Financial Literacy

Financial literacy is the ability to make informed financial decisions with a clear awareness of the long-term effects. A financially literate person uses financial instruments wisely and manages their personal finances effectively. Moreover, placed in a situation of limited information, a financially literate person can determine this, research and find the information he needs, and only then make a decision. Last but not least, the financially literate student manages to realize his role in society from an economic point of view.

Why develop financial literacy?

Developing the skill is important for forming a sense of personal responsibility for one’s own well-being. Failure to master this skill can negatively affect self-esteem. In addition, it affects feeling of personal satisfaction with money conditions and family status.

Make Money In Forex Trading

Since the micro-interest in conventional financial investments, many investors have learned forex trading in addition to stock or crypto investments.

Forex is short for “Foreign Exchange Market” and describes the global market for trading currencies. By far, Forex is the most liquid marketplace in the world.

Can anyone trade forex in ZuluTrade broker?

As an individual forex trader, of course, you are a minor little fish in this industry. Private traders should therefore look for a forex broker who handles the forex transactions. You should benefit from broker review so you can earn money successfully not only in forex but also in another trading like crypto.

Since forex is not controlled by any supervisory authority, shareholders should ensure that the broker is located in a country with appropriate financial supervision.

How does forex trading work?

In the forex market, currency pairs are always offered at one price. The currency in front is the so-called base currency that is being traded.

If the value of the euro falls against the dollar, the forex investor can purchase back more euros for the dollars he has acquired than he invested. This so-called “spread” is the investor’s profit.

For the major currencies, these spreads are typically tiny. For the private trader, however, this can still be lucrative because you can trade with considerable leverage.

Do you need profound Forex knowledge as an investor?

If you don’t want to go swimming as a private forex trader, you must deal intensively with the market and its rules in advance. Trading takes place on the web in milliseconds and is sometimes subject to significant fluctuations and risks.

It is worthwhile for traders to comprehensively analyze currencies and their situations. Currencies are an asset like any other. According to the rules of the professed “fundamental analysis”, every asset represents a fair value. If the commercial value and fair value match, experts speak of a “fairly valued material asset”.

Forex trading is one of the most attractive attractions in the financial world. In the foreign exchange and crypto market, large sums of money are moved across different regions in fractions of a second. With the right brokers, investors can take part in this industry and move huge volumes with little money.

Good Reason For A Regular Investment

Would you like to improve the return on your savings and take the first step in investing, but don’t know how to do it? Why not try investing regularly? This solution consists in investing an equal, predetermined amount in an investment fund on a regular basis.

You can invest small sums

Investing in a regular investment plan does not require a large capital outlay. A two-digit sum is already sufficient. In many cases, no entry or exit fees are charged. Each deposit is placed at regular intervals automatically in a diversified investment fund that allows you a higher return than your savings account.

How To Save Money On Heating And Cooling

Reducing costs when heating is feasible but avoiding costs completely is hopeless. If you don’t have a tiled or wood-burning stove in your home, you don’t have any sensible alternatives for heating. On the other hand, if your heating system has some issues, furnace replacement can help you save money on heating.

Do not block radiators with furniture

If there is a sofa or chest of drawers in front of the radiator, the heat accumulates behind the piece of furniture and is not properly released into the air in the room. Therefore, you should leave at least 30 centimeters between the radiator and furniture. Curtains should also not be hanging in front of the radiator to avoid heat build-up. Curtains should be short enough to end above the heater or tie to the side.

Close shutters, blinds, shutters and draw curtains

As soon as it’s dark outside, it’s worth lowering the shutters. Roller shutters, blinds, window shutters and curtains help to ensure that the heat does not disappear through the windows so quickly. They serve as a kind of additional thermal insulation for the windows.

Airing: short, but right

You actually know better, but you still do it again and again in everyday life. Instead of ventilating briefly, you tilt the window after showering or when cooking. You save energy if you ventilate the room several times a day for a few minutes instead of keeping the windows open all the time. With tilted windows, the walls cool down more and it takes a lot of energy to heat them up again. Incidentally, the quickest way to exchange air is to open opposite windows at the same time so that the air can flow through.

Compared to tilted windows, targeted ventilation can save up to 12.5 percent. With the current electricity, oil and gas prices, it’s well worth it.

Adjust the temperature according to the room

Because you usually spend most of your time under the covers in the bedroom, it is sufficient if the temperature there is no more than 18 °C. In rooms where you spend the day, for example in the living room, in home office studies and in children’s rooms, the temperature can be 21 to 22 °C. Just one degree less room temperature reduces heating costs by six percent. Thus, you can save money if you reduce the temperature.

Finance: Don’t Live Beyond Your Means

Those who are good with money know what they can spend. Even if the wishes and the temptation are so great, only the money that you actually have is spent. Everything else will have to wait or have a solid financing plan.

You keep a household book

Sounds absolutely old-fashioned but it is a proven way to keep an eye on income and expenses and to get along with your budget. Your grandmothers and grandfathers already knew that. Everything used to be written in a booklet, but today there are apps for that.

Crypto Importance In The Financial System

Being innovative and acting innovatively is an imperative in all areas of the economy today, especially in the financial system. Processes should become cheaper, more efficient, but also more flexible, products more dynamic, more accessible and more individual. In addition, new target dimensions are to be achieved that have long been neglected, such as ecological and social sustainability. More and more people are using bitcoin platform such as Bitcoin 360 to achieve financial goals.

Cryptocurrencies as a technological innovation

The technical core is about a coordination problem in a distributed network structure. Although there are many different cryptocurrencies today, their basic principle can best be explained using Bitcoin. Bitcoin was featured in a 2008 white paper by an author or group using the pseudonym Satoshi Nakamoto. The first sentence formulates the ambitious goal for Bitcoin.

Bitcoin should therefore enable two people to send each other a form of electronic money directly. They can do this without the intermediary of a financial institution. Anyone who makes a transfer today does not do so directly. They instruct a bank to transfer an amount from one account to another.

Although the rights of customers are contractually regulated, it is technically a hierarchical relationship in which control remains with the financial institution. The direct peer-to-peer approach aims to separate the financial institution from the process, known as “disintermediation”. “Peer-to-peer” means a network of computer connections in which the computers involved are more or less equal.

Potential for the financial system?

On a technical level, cryptocurrencies are still a niche phenomenon that represents the solution to a special problem. Bitcoin and some other cryptocurrencies can now reliably map a limited number of transactions in a distributed network. However, this raises the question of whether this special solution creates enough added value to justify the enormous costs it causes. Today the answer is rather no. The willingness to accept is still low, the problems are significant and the negative consequences enormous, from power consumption to ransomware and dealing with investors.

Today, cryptocurrencies are primarily supported by their existence as an investment object in the context of financial innovation. However, this should not be used to conclude that the technology potential is much more limited, as the illustration shows.

However, this development is quite risky when it comes to the question of the social benefits of cryptocurrencies. With the combination of horrendous market valuations and weak but fascinating technology, you run the risk of wasting your energies looking for the problems that fit your supposed solutions. Instead of letting the direction be set in this way, it is now more important to ask what social goals you want to achieve with your financial system.

How To Get Money To Start Towing Business

So you have a killer business idea and you want to start a business? How do you get the start-up funding you need to take your new business from idea to success?

How to get money to start a towing business

Your own pockets

This may seem daunting at first, but it is the most popular source of business startup funding. Don’t have a nest egg? Many people get the start-up capital they need by mortgage or re-mortgaging their homes, or by selling property or possessions, even if they manage to get a business loan. Credit institutes and investors generally expect a personal financial commitment from the founder of a new Towing Service San Jose business. Learn from the experts in the field of towing. Find them on the maps – https://maps.app.goo.gl/uhDrZyQQ65fMW7aa6.

Family and friends

The second most popular source for getting money to start a business is family and friends. They are often willing to provide a startup loan or sometimes even an outright gift to get your new business off the ground. After all, they’re probably already pre-sold on the value of your business idea to some degree since they’re people who want the best for you.

A line of credit

Not recommended as the sole source of seed capital, a line of credit is essential for the start-up phase. No matter how carefully and detailed you have created your business plan, there are always unexpected expenses that you underestimated.

Hopefully, before you decide to start a towing business, you have already prepared yourself to access this source of money by establishing a relationship with your local bank manager and making sure your credit is in good shape. No bank will extend a line of credit to someone they don’t know, especially if that person has no credit rating.

A business loan from a bank

The term bank refers to traditional lending institutions such as banks and credit unions. It’s easier than ever to get business credit from these traditional sources as more people than ever have successfully started small businesses and the big banks are more interested in small businesses than they used to be.

That means you can’t just walk in, tell a credit manager how much money you want, and expect to walk away with it. Applying for a business loan is a process that you need to prepare for.

A business loan from a corporate or government-sponsored organization

There are many organizations whose purpose is to promote economic development or to assist specific groups of people to succeed in business. Often, this help also includes financial support, such as start-up loans.

Finance: Why Use Budgeting Software

A budgeting app can make it much easier to keep track of everything by allowing you to view all of your accounts in one place. Once you have your budgeting software set up to automate your budgeting, you should consider automating other aspects of your financial life. This should include transferring of cash to a savings account or to invest.

Why is it important to manage a budget?

Subsequently, budgeting lets you to form a spending strategy for your money. This ensures that you always have enough money for the things you need and for the things that are important to you. Sticking to a spending plan or a budget will also allow you to stay out of debt or work your way out if you are presently in debt.

What are the three types of expenses?

There are three main types of expenses that people pay: fixed, variable, and recurring.

What are the pros and cons of budgeting?

- It becomes a lot easier to save money when you know exactly how much you can save each month.

- Pay on time. If you don’t have a budget to guide you, it can be difficult to make sure all your bills are paid on time.

- Time sensitive.

What are the main reasons for budgeting?

A budget keeps your expenses in check and ensures your savings are on track for the future.

It helps you keep track of the price.

It helps ensure you don’t spend money you don’t have.

Budgeting software helps lead to a happier retirement.

It helps you prepare for emergencies.

It helps shine a light on bad spending habits.

Are monthly budgeting software and apps safe to use?

Budgeting apps offer the convenience of all your financial data in one place, making it easy to monitor your expenses. The good news is that it’s not as dangerous as you might think, provided you use a reputable monthly budgeting software.

Is a monthly budgeting software worth it?

Budgeting software and apps are excellent at budgeting. You know where your money is going. You can manage your finances well. The services are so versatile that any budgeter can set up savings and manage expenses.

How To Manage Your Finances Wisely

With careful management of your finances, you can not only save money cleverly, but also achieve goals faster.

You should always keep an overview of your finances

The future is particularly unpredictable. There are things that you can’t plan for no matter how determined you are. What you can do, however, is prepare as best you can. It is therefore very important to always have an overview of your own finances. This gives you a concrete understanding of your liabilities, liquidity, and income.

In addition, it reduces financial stress and supports your current needs. It also builds a safety net in the form of reserves for your retirement.

Financing Kitchen Cabinets Start-Up Craft

Self-employed entrepreneurs have to support themselves. They always aim for growth and work in a disciplined and structured manner despite all the challenges of everyday life. That means right from the start. You have to be always focused and work on your own company.

There is no time for private problems and distractions. Holidays and free time are often neglected in economically difficult years and especially at the beginning of a business start-up. And yet the self-employed craftsman must always be healthy and fit.

The right motivation and prerequisites for wholesale kitchen cabinets entrepreneurs

Yes, being your own boss. This is the motivation for many start-ups and young entrepreneurs. Theoretically, there is also the fact that a self-employed person has no upper income limits, provided he is really good in his field and has mastered the business.

From a purely economic point of view, there are currently optimal conditions for starting a business in the cabinet making industry. Remember that the lack of skilled workers in the wholesale kitchen cabinets trades can be a serious problem.

How much do you earn as a self-employed wholesale kitchen cabinets craftsman?

First of all, income should never be the motivation for starting a business. Money will only make you happy for a short time. And sometimes it will be more and sometimes far too little money. Rather, you must enjoy the work you do every day to such an extent that you are willing to live happily for several years with a modest income while pursuing your passion.

On average, there are well-earning craftsmen among employees as well as among the self-employed. On average, the difference in income between employees and the self-employed is small. However, there is a clear trend. Those who employ their own employees usually earn more than employees and solo workers.

There are also master craftsmen who earn significantly more than a doctor. But there are also many individual entrepreneurs in the trades who live on the subsistence level and cannot get by without help. If you’re really good and competent, you’ll find your customers easier and more likely to earn more money.

SEO Tips for Financial Service Websites

SEO for financial services is an essential digital marketing strategy for the finance and banking sector, helping prospects find your website from search engine results pages. In short, SEO for financial services companies can help you leverage relevant organic searches to drive natural traffic to your financial services pages. Undoubtedly, financial services’ careful optimization of the website for search engines will yield a significant return on investment. Let’s look at how investing in financial Phoenix SEO can give you an edge over your competitors.

SEO for financial services is an essential digital marketing strategy for the finance and banking sector, helping prospects find your website from search engine results pages. In short, SEO for financial services companies can help you leverage relevant organic searches to drive natural traffic to your financial services pages. Undoubtedly, financial services’ careful optimization of the website for search engines will yield a significant return on investment. Let’s look at how investing in financial Phoenix SEO can give you an edge over your competitors.

SEO Keywords

Keywords are the lifeblood of financial SEO. To understand what they’re looking for when seeking financial services or advice and to create pages that answer those questions and requests so that Google can provide options as users browse search results.

Content is King

Today’s internet is a content-driven machine, and this is especially true for financial SEO. Financial content provides Google’s roadmap explaining what the site is about. It also provides value to your website visitors and can be essential to economic lead generation. Suppose you have quality financial content on your website. In that case, it will be a better resource, so search engines reward relevant financial content with high rankings and targeted traffic.

On-page SEO and Technical SEO

Technical SEO is about optimizing the content and code of your financial services website to make every page search engine crawler friendly. Googlebot is an automated program that retrieves, indexes add, or updates content in Google search results. The more attractive your page is to Googlebot, your SEO efforts will be more effective. Technical know-how is helpful for on-site strategy.

Improve “EAT”

EAT stands for Expertise, Authoritativeness, and Trustworthiness, the principles that Google judges website quality. Expertise refers to source references. For example, Google wants to return results from trained lawyers if you search for legal questions. For recipe results, websites written by experienced chefs are preferred. The more you can prove your expertise, the higher your priority in search results.

Site Speed Score

The website speed score represents how fast your website loads. Specifically, Google’s PageSpeed score is a number out of 100 assigned to a page and is related to how fast it executes. The higher the score, the quicker the website. Page speed affects many factors that affect ranking. Google’s priority is to provide a great user experience for those who use our search engine. This means that fast-loading websites are prioritized.

Earn Money As A Life Insurance Agent

You can also earn a lot of money with a traditional job. Commercial professions in particular are very suitable if you are looking for a high income. This is because you can supplement your regular salary. One of these professions is that of insurance agent. If you run it with motivation and can place many customers, a very high income is possible.

Requirements to work as a corporate owned life insurance agent

If you want to become a corporate owned life insurance agent, you first have to do an apprenticeship. It should be borne in mind that more than two thirds of the trainees have a general university entrance qualification. This makes getting started so much easier. However, it is also quite possible to get an apprenticeship with a certificate. In this case, however, you have to assume that you may have to search much longer. Theoretically, you can also get an apprenticeship without a school-leaving certificate.

In addition to training, which is an important basic requirement, personal suitability should of course also be given. As an insurance salesman, it is particularly important that you come across as trustworthy. Otherwise you will very quickly run into difficulties if you want to offer your insurance to the customer. It is also important that the other person can be assessed. So you should be able to adjust the insurance according to the customer’s wishes. Since constant customer contact is very important, social skills are generally of enormous importance.

But there should also be other personal characteristics if you are interested in the job of an insurance salesman. This also means that you have to have a certain level of perseverance. Bad days are not uncommon and also happen to the best insurance salesmen. So if you haven’t arranged insurance for several days, you don’t have to put your sand in your head. It can also go uphill again quickly.

What opportunities you have as an insurance salesman

In addition to the large amount of money that you can earn through commissions, the profession of insurance salesman offers even more opportunities. The most important thing is that you can continue to develop. There are numerous training opportunities available. You can specialize in certain areas and gain additional qualifications. This can help you get better paying jobs. In the best case, you not only have a better basic salary, but also higher commission payments. You should not forget that your own knowledge can be marketed elsewhere.

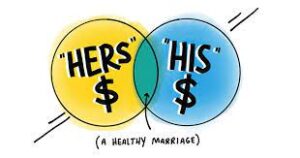

How Couples Talk About Money & Finances

Money plays an important role in love. It influences the course of a relationship, among other things. But how important is the value of money among lovers?

Some relationship breaks up for financial reasons. And the higher the salary difference between the partners, the greater the potential for conflict in the relationship.

Financial security comes before looks

Power and money have a decisive influence on how you perceive a person. For some people, it is clear that a high income automatically makes you attractive. For some, financial security is even more important than good looks. And many people even puts money ahead of intelligence.

Why You Should Be Invested In The NFT Hype?

NFT stands for a non-fungible token. Or a picture that cannot be replaced. It’s unique. In this case, a unique digital file. This is often a digital work of art. That can really be anything. From a new armor in a familiar game to an emoji. NFT is also used to make someone the owner of a digital work of art. That is also necessary. Because if there were no ownership, the file could be duplicated infinitely. Then there is no longer any question of an irreplaceable (unique) digital work of art.

Despite this knowledge, it is still incomprehensible to many people why so much money is spent on a simple digital file. Why do people sometimes pay millions of euros for a small digital file? What makes this so special? How did the hype come about and what exactly does the future of the NFTs look like? And what does this mean for the people who are interested in NFT? Should you join NFT alpha groups first? Is it wise to invest in this now? What’s in it for you?

All these questions and still too few answers. In this article, we try to change this.

The huge hype about NFTs

NFTs have been around for many years. However, there was no talk of hype yet. As with many other hypes, these often only arise after a special and above all surprising development. You also saw this with bitcoin, for example, when a young Dutch person suddenly earned millions. Simply because he had bought in at the right time. A lot of people suddenly saw trading in bitcoin as a way to get rich quickly. Of course, these are just exceptions, but they do fuel the popularity enormously. We also saw this at NFT.

The hype about NFT has been around for quite some time. However, this also became clear to the general public in the spring of 2021. At that time, an NFT was sold in a traditional auction house. It was the very first time in years that this happened. It was a sum of no less than 69 billion. A few weeks later, the very first tweet from the founder of Twitter was also sold for 2.9 billion dollars. This news was even discussed on the NOS eight o’clock news. And when that happens, you know that everyone is going to talk about this. The hype had really started.

When do you buy an NFT?

This is a good question and different for everyone. An NFT is always bought (and sold) on an NFT Marketplace. This is done through cryptocurrency. People who buy an NFT often have different intentions with this. One is simply an art lover and has fallen in love with a specific digital file. The other think mainly from profit and has the feeling that more can be gained from such a unique file over the years. This can lead to an NFT being purchased for a reasonable amount and reappearing on the market in a few years.

ALSO READ: 7 Tips To Make The Most Money In Selling Your House

Financial Guidelines For Women

Women often assume that they have too little financial knowledge. One thing is particularly important when it comes to retirement provision. The earlier you start, the better. However, income inequality and the unequal distribution of roles prevent many women from investing in the capital market.

Women pay attention when investing money

Women often find the subject more complicated than men. According to a survey by the banking association, women perform worse than their male counterparts when it comes to exemplary questions from the financial world. Only around 40% knew what a mutual fund is. For men, it was almost half.

Women in particular pay particular attention to security when investing money. Around 74% of investors rate security as particularly important. For men, it is only 64%. Perhaps that is why forms of investment such as savings accounts, call money and time deposits are extremely popular. But that alone is not enough to offset inflation and build wealth in the long term. Instead, you should also think about investing in the capital market.

What are the Functions of Money & Finance

Society generally accept money as a means of exchange and payment. You use it to exchange and acquire goods and services. In addition, it is a measure of value and price as well as a unit of account. You can use it to evaluate and compare goods and services. Money serves as a means of transferring value because it is a means of exchange and a store of value.

Functions of money in the modern economy

- General means of exchange and payment

- Value meter and unit of account

- Store of value

- Means of transfer of value

As a general medium of exchange and payment, you use money to exchange goods and services.

What Is Money and Finance?

People consider money as an economic element that functions as a medium of exchange intended for transactional commitments in an economy. It provides the service of decreasing transaction costs, specifically the double concurrence of wants.

In order to be most useful as money, a currency should be

- Fungible

- Durable

- Stable

- Portable

- Recognizable

Generally, people accept, recognize, and centralize money as a medium of exchange in an economy. They use it to facilitate transactional trade not only for goods but for services as well.

Financing Car Down Payment or Cash

It used to be the case that if you put the money on the table in cash, you have the best chance of big discounts on the list price.  However, as new cars become more expensive, many find it harder to pay the full price. And even if you can, paying in cash may not be the best solution. if the money is still in the bank with good interest, car financing may be worth more. So, a car down payment calculator will be a big help.

However, as new cars become more expensive, many find it harder to pay the full price. And even if you can, paying in cash may not be the best solution. if the money is still in the bank with good interest, car financing may be worth more. So, a car down payment calculator will be a big help.

In addition to buying a property, many people consider their own car to be the biggest purchase they will make in their lives. The dream car may be found quickly – or another vehicle that is useful for one’s own purposes. But when it comes to paying, it gets complicated.

Buying a car: How it used to be

People used to save on new cars sometimes for years, in order to pick up the vehicle from the dealer with the suitcase of money in an almost ceremonial procedure. Today only about 30 percent of new car buyers pay for the car in cash. Others use finance or lease options. But again, there are many variables to consider.

Financing the car: Here’s how

When financing by credit, you as the buyer basically have the choice between your house bank, other credit institutions or the bank of the car manufacturer.

Which payment option is cheaper?

In principle, neither the house nor a manufacturer’s bank can be recommended in general. It depends on the individual offer. In the meantime, the low-interest rates have also reached car loans, especially those from direct banks. Loans over 60 months at an interest rate of well under two percent are no longer uncommon.

In principle, however, the following still applies. The higher the down payment that you can afford, the lower the loan amount. Thus the accumulated interest that you pay over the term is lower. In addition, a far-sighted calculation is a must.

The cash payment

You don’t have to deal with such questions if you pay for the car in cash. The car is yours immediately after signing the contract. You could, for example, sell it immediately to make a deal if you got a bargain.

More importantly, if you put the money on the table in cash, you may be able to negotiate the best discounts. Because for the dealer there is no risk that you will run out of air with the alternative financing by instalment payment.

Understanding Finance and Money

Finance is the study of optimal asset allocation. Organizations or individuals must make an investment in order to achieve the highest possible return over time.

Branches of finance

Personal finance

Personal finance refers to the income and expenses of an individual or household, taking into account the savings, investments and the amount they expend as an expense.

Public Finance

Public finance deals with the activities of the government in the economy. That is the government revenue from various sources such as taxes, fines, fees, tariffs, etc.

Corporate Finance

This deals with the management of the funds of the organization. Companies have to maximize their assets and thereby increasing the value of shares in the market.

Why Financial Freedom Is important?

Financial freedom and independence are colourful terms. However, they mean something different for everyone. Some feel comfortable with a minimalist way of life, others need fast sports cars and pompous real estate in order to feel “financially free”.

The basic concept of financial freedom

The basic concept of financial freedom is always the same. Everyone who strives for financial freedom must take their finances and the associated risks into their own hands. They need to decide how they can build their own sources of income independently of institutions, the state and companies.

So far, only a few private individuals have followed a strategy that slowly leads them to financial freedom. Most people spend what they earn, leaving no room for growing passive income streams.

Bankruptcy Proceedings

Individual recognition of financial bankruptcy has been permitted since 2015. The presence of long-term enforcement procedures often facilitates this situation. The bankruptcy debt obligations are deemed satisfied as soon as the bankruptcy procedure is completed and the arbitration court’s ruling is issued. This is true for enforcement actions as well. Enforcement procedures must be stopped, suspended, or terminated for the reasons set out in the legislation. It depends on where the bankruptcy is in the process.

Bankruptcy proceedings

The debtor is required to declare bankruptcy if he has a significant quantity of financial commitments and is unable to meet them. A matching application is prepared and submitted to the Arbitration Court at the location of registration to begin the procedure. It’s accompanied by documentation proving the existence of illogical financial commitments. Here are the arrears in enforcement procedures. The first public hearing on the application will be scheduled by the arbitral panel. It endorses the finance manager’s candidacy. If the facts provided in the application are found to be true.

Termination of enforcement proceedings opened against a bankrupt debtor

If a debtor has a large number of financial obligations that he is unable to pay, he must file for bankruptcy. To begin the procedure, a matching application is prepared and submitted to the Arbitration Court at the registration location. It’s supported by paperwork that demonstrates the presence of unreasonable financial obligations. The following are the outstanding enforcement processes. The arbitral tribunal will hold the first public hearing on the application. The finance manager’s candidacy is endorsed. If the information given in the application is confirmed to be accurate.

The practice of terminating the consideration of bankruptcy cases

The termination of an individual’s bankruptcy case in exchange for the return of a debt or the signature of an amicable arrangement is an understandable explanation that essentially causes no disagreement among the process participants. The remainder of the grounds, on the other hand, may spark a lot of debate.

Consequences of Termination of Insolvency Proceedings

Because the law does not explicitly specify the repercussions of such a circumstance, the outcome will be similar to the debtor’s refusal to be declared bankrupt. Furthermore, much will be determined by the grounds for dismissing the bankruptcy case, as well as the borrower’s and creditors’ unique circumstances.

Registration of the application

Any participant in the process can submit a termination application. They might be one or more creditors, the debtor himself, or, in rare instances, the person with the least stake in the case’s result – the financial manager. There is no one-size-fits-all application form. Standard forms are available in the legal bases “Garant” and “Consultant.”

Who Can Dismiss a Bankruptcy Case

It can be exceedingly difficult to halt the bankruptcy mechanism once it has been activated. A bankruptcy creditor can file a petition to terminate bankruptcy in an arbitration court under Federal Law No. 127-FZ. It is a powerful body in charge of overseeing financial commitments. Its activities are aimed at preventing arbitrary insolvency procedures from being initiated. Lawyers concur that restoring the debtor’s solvency during the financial recovery, dog bite lawyer Los Angeles and external management procedure is extremely tough. The insolvent person’s primary obligation is to begin the settlement procedure, while creditors can take independent steps to restore and offer guarantees, as well as debt restructuring.

Learning about the Financial Market

The financial market is the totality of all markets on which you can trade capital.

The money market

The money market is that part of the financial market on which people can trade short-term money market papers. These include, for example, overnight and time deposits and investments with a maximum term of one year. The main players in the money market include banks, insurance companies and fund companies, with the central bank being the main player. This is because this affects the supply and demand of money, for example by providing additional money.

Money in Relationships

Many couples in our society end up breaking up for financial reasons. Often, one of the partners feel overwhelmed by the responsibility of having to provide. Other times one of the partners does not have good financial habits. They make poor decisions when it comes to managing money. Other times these couples have different lifestyle and expectations. This is basically alright but one needs to learn how to ensure that money does not break up your relationship that could be potentially healthy and loving. The first and most important element is making sure that you understand and recognize why money broke your relationship. You need to make a step back and take accountability for your short comings and the things that you could have done better. Step back and understand your partner’s perspectives, values upbringing and their relationship with money. If you stay centered around your own perspective, you will ultimately keep on making these mistakes over and over again.

The best thing that you can do after a breakup is to learn from the experience. This will help you become a better person and partner. Once you’ve identified what the issue is, you need to come up with a plan to make sure that you develop better habits or more realistic expectations and financial IQ in order to ensure that you won’t do the same mistakes. The best way to develop a clearer plan is to for you to work together with your partner. Take action. It’s not just an intellectual exercise but about building positive patterns and habits in your daily routine to become that improved version of you.

Common Idioms Used on Finance and Money

An idiom is a group of words which have a different meaning when used together from the one they would have if you took the meaning of each word separately.

Here are some common money and finance idioms. You can incorporate them in your vocabulary and be well equipped and informed when it comes to money and finance.

- To cut corners. If you cut corners, this may mean you have a problem with budgeting. Try not to spend too much money as you should. This may also mean to try to do the job in a cheaper way. This may mean buying cheaper materials to finish a project instead of the more expensive ones. Here is an example on how you can use it in a sentence. E.g. Even if we’re on a budget, try not to cut too many corners.

- To cost/To charge the earth. This idiom means, it’s too expensive or costs a lot of money. g. It costs the earth to buy a sports car.

- To cut one’s losses. This means that you should abandon a venture or a business in order not to lose more money. E.g. I think we should cut or losses and sell the business.

- To feel the pinch. If you feel the pinch, this means you are starting to notice the lack of money and finances you have. g. Mary has been unemployed for many months and she’s starting to feel the pinch.

- On a shoestring. To do something in a shoestring is doing it without many financial budget or resources. One tries to do things cheap. One tries to be economical. E.g. It’s hard to run a business in a shoestring budget.

- Money spinner. A money spinner is something that is successful and generates a lot of money. E.g. It’s not easy to run a business idea into a money spinner.

How to Manage Your Personal Finances?

Did you hear someone saying to you that money does not grow in trees? You’re not alone. But unfortunately for many that’s all the financial advice they ever got. Now, many are ready to take on the challenges of the real world and try to make sense of their financial affairs. But whether you’re out on your own or just thinking about it, the real world maybe nothing like you imagined. In fact, many realize how tough it is to survive out there. Why? Because money is a big deal. Maybe even more than you ever taught. It affects everything in your life. You might even be wondering, how am I able to do it all. That’s why the best time to learn how to manage your own personal finances is right now. Because personal finances are not just for your parents or for people with a lot of money, it is for everyone.

How you manage your personal finances now sets up habits that will stick with you for a life time. And though it’s never too late or to early to start learning about managing your personal finances, the sooner you’ll do, the longer you will enjoy the benefits of what you’re bound to reap.

Make your money grow!

Money can grow fast or slow, over a few months or for years. It grows in all kinds of different places. But money cannot grow in under your mattress or buried somewhere in your house. Money only grows when you help make it grow. So what does it take to make your money grow? Surprisingly enough, it takes only a few dollars. In fact, the penny saved is indeed the penny earned and sometimes, even more.

Options for People Who Hate Budgeting

Keeping a detailed budget can be one of the best way to help you save money and avoid overspending. But not all people has the time or the desire to sit down to work on a spreadsheet at a regular basis. Some may have tried to keep a budget before but did not work out. Fortunately, there are some ways you can manage your finances without the traditional spreadsheet. The most important part in managing your money is making sure that your needs are covered. This will require simple math and is not complicated. Start by listing down all your regular monthly bills and expenses, like, Mortgage, utilities, insurance, any loan or credit card payments you make it much. Then estimate necessary expenses like groceries, transportation. Add all this costs up and you’ll have your monthly expenses. This is what you need to cover every month.

When it comes to paying your regular bills list it down in your calendar to help you be reminded to pay them a few days before their due date. To make it easier try automating some of your monthly expenses. You can sign up for an automatic bills pay with your utility companies, lender, car loans and mortgage. The amount you owe each month will be automatically withdrawn from your bank account or charged to your credit card. Automating payments can save you time and efforts every month. This is a good way to make sure that your bills are paid on time. Just be sure to always have enough money available in your account to cover all of your automatic withdrawals. When you use a credit card make sure that you can pay the balance in full each month in order to avoid paying interests in these charges. Automated payments can always be cancel whenever you want. Automated payments are also a great way to help you systematically pay out debt if you set up extra payments to your loans. It can also help you grow your savings if you set-up a regular contribution to a saving account. This can be helpful if you have trouble saving in the past.

Should You Work With A Full-Service Investment Broker Or A Discount Investment Broker

When you want to participate in the financial markets, you may need the assistance of a reliable qualified broker. A broker would refer to a firm or an individual that charges a commission from clients for the assistance they provide in buying and purchasing products in the financial market you participate in, such as the forex market. These products in the financial markets could be in the form of stocks and bonds, real estate, insurance products, and even cryptocurrencies. Every financial market has its brokers and the services offered by brokers working in the same market and industry can vary.

When you want to participate in the financial markets, you may need the assistance of a reliable qualified broker. A broker would refer to a firm or an individual that charges a commission from clients for the assistance they provide in buying and purchasing products in the financial market you participate in, such as the forex market. These products in the financial markets could be in the form of stocks and bonds, real estate, insurance products, and even cryptocurrencies. Every financial market has its brokers and the services offered by brokers working in the same market and industry can vary.

For instance, FinMarket is an online brokerage firm owned and operated by K-DNA which was founded in 2015. They are relatively new in the Forex (Foreign Exchange) market but this young yet growing brokerage firm have received positive feedbacks and views from its clients as well as various reviewers, including from the analyst team of AskTraders. If you want to find out more about what FinMarket has to offer, do check out finmkt review.

Making An Investment – Working With Brokers

As mentioned, there are brokers that work in different financial markets. If you intend to make an investment or trade in the financial market, you should know what type of broker you are to work with as well as the services they provide. Let’s have a look at two:

FULL-SERVICE INVESTMENT BROKERS

FULL-SERVICE INVESTMENT BROKERS

As full-service investment brokers offer a very comprehensive service to their clients, the commission fee they charge is the highest. If you are looking for a thorough and full assistance when choosing as well planning investment purchases, a full-service investment broker or brokerage firm is your best option as they can have a division or department of expert research analyst to aid investors in picking the most fitting portfolio products for them. On behalf of the client, brokers could directly make purchases, manage a portfolio actively, as well as aid in selecting and organizing retirement accounts. It is imperative that you choose your full-service investment broker well to make certain you are provided with the best and most efficient services that meets your investment needs.

DISCOUNT INVESTMENT BROKERS

Discount brokers merely buy and sell on behalf of their client investment products. They would charge lesser commissions compared to a full-service broker; however, they also don’t provide enough assistance when it comes to choosing investment products. If you already have a firm hold on market accounts, which includes being able to do research on your own, you could work with a discount broker.

If you are an investor searching for a good avenue to make an investment, consider working with a broker as it will surely benefit you greatly. Professional reliable brokers are more updated with news, trends, and events in the financial market and has a fiduciary responsibility to advise clients which is for their best interest. With that, make certain you choose your broker well.

7 Tips To Make The Most Money In Selling Your House

To sell your house for the most money, it is ideal to know local trends in your marketplace, the entire price of selling property, and the very best way of selling to satisfy your objectives. The maximum offer will not always give you the most cash, and you will not necessarily recoup the expenses of significant renovations.

In earlier times we have covered the aspects that help determine the value of your house such as place, repairs, and also the market. Below are some things you should think about to sell your home for the most cash:

1. Know your Regional Sector

Whenever there are more houses available than there are buyers, then it normally brings costs down since sellers vie to get fewer buyers. We frequently call this type of buyers’ market. On the flip side, whenever there are more buyers than there are houses available, it has a tendency to drive up prices as buyers vie for fewer houses. We call it a sellers’ market.

A fantastic way to judge whether you are at a buyers’ or sellers’ market would be to have to take a look at the ordinary Days on Market for comparable houses in your region. DOM is a property statistic that shows just how long houses are actively recorded in the marketplace. If similar houses to yours have been selling quicker than the typical DOM for your region, then it may suggest a strong need.

You might also need to check at the speed of house price appreciation for houses in the market. Home price appreciation demonstrates how quickly home costs are increasing; a steep growth can indicate that buyers will be paying more.

These trends will affect how you deal with your house and your capacity to negotiate things such as repairs and extend contingencies. They are also able to offer you insight into how much time it will have to sell your house, which will affect your prices. Investigate marketplace trends in your area or see our comprehensive manual on the now’s home market.

2. Select the Right time to market

Home sales pitches and flow with the seasons. Spring usually attracts the maximum buyers since a lot of men and women wish to move throughout the warmer months once the children are out of college. While seasonal tendencies vary on the market, they are not the sole element to think about when considering “the ideal time to market.”

To sell your house for the most money, it can be of assistance to sell at some moment when you have sufficient equity in your house to repay your present mortgage, the expenses of sale, and also the expenses of going. Otherwise, you ought to pay a number of these expenses from your pocket. According to current statistics in Bankrate:

Most homeowners don’t assemble sufficient equity in their house to counter purchasing, final, and shifting prices until they have been at their house for approximately five decades.

Timing your purchase to obtain a greater cost can also struggle with other lifestyle priorities such as moving to get a new occupation, assisting aging relatives, or beginning a family of your own. As an insta

nce, if you time the selling of your house for the peak selling period but overlook a significant job opportunity for a result, that may really have a worse fiscal effect.

3. Establish the Ideal price

If you overprice you are house, then you risk having to drop the purchase cost, taking more time to sell, or even which makes it more difficult for buyers to find your own record. Over the years, buyers may get skeptical of houses where the record price is constantly decreasing, indicating that there’s something incorrect with the house or the vendor has unrealistic expectations. This can restrict your bargaining power because buyers may perceive the tendency for a signal your house ought to be disregarded.

Based on Homelight, many buyers also look with a cost range so, in the event that you price your house beyond what a sane person would cover, you create your house harder to find.

Ultimately, taking more time to market can have wider financial implications, particularly if there’s anxiety to maneuver inside a shorter time period. As an instance, even when you’re ready to market at the desired price, you can incur home overlap prices like paying for a dual mortgage, storage charges, and leasing a temporary home. You could also lose out on a fantastic buying opportunity.

When pricing your house, a fantastic place to begin is our house worth tool, which employs the most recent market information for similar houses. As an alternative, you can ask for an all-cash deal. We compute your house worth dependent on the information which that you supply about your house, current market trends, and information in countless current comparable home sales. Requesting an offer is totally absolutely completely free of charge, and there is no obligation to take it.

4. Understand just how much it actually costs to market a House

When purchasing a house, it’s easy to fixate on the 5-6% that is typically compensated in property agent commissions. But if you factor in the rest of the costs –closing expenses, seller concessions, upkeep, and repairs, moving and house prices costs–the entire price of selling could attain nearer to 10 percent of the selling price.

A number of the aforementioned mentioned costs are more difficult to control like broker commissions and closing prices. But you might have more sway over the best way to prepare your house for selling and the best way to negotiate the selling; we will dive deeper into these issues from the sections below. The purpose is using a complete image of your prices permits you to decide on a budget and determine opportunities to make savings.

ALSO READ: Common Mistakes People Make With Their Money

5. Determine how you are going to market

Most individuals are knowledgeable about the conventional property process: preparing your house for sale, locating a broker, list your house, showing your house, negotiating with a buyer, then ultimately closing the offer. But, there are different procedures to make the most of your profits, such as for-sale-by-owner (FSBO) and also selling on sites such as Sell House Fast UK (visit to learn more).

Within an FSBO sale, you’d basically take on each one of the duties of a realtor. As a result, you may avoid paying the list brokers commission, however, when a purchaser is represented by an agent, you will probably have to pay the purchaser’s agent commission. It is possible to find out more about commissions within our guide to investing in a house. Unless you are an experienced real estate specialist, an FSBO sale may be a complex undertaking that can do more damage than good.

The benefit to the vendor is that the certainty of an aggressive, all-cash deal and also the capacity to command the deadline. Rather than paying broker commissions, you also get a payment to the ceremony; that differs in the “home-flipper.”

6. Contemplate minor renovations which add value at minimum Price

Not many home improvement jobs are made equally. By way of instance, according to information from the home improvement worth calculator, a finished basement in Portland will be 5x much more precious than completing a cellar at Atlanta, a roughly 13% growth to the median house value versus 2.5percent respectively.

The effect of a job or update varies dependent on the market you are in, and you are present home worth. Some jobs like including a pool or timber floors generally have larger gains for much more expensive houses, while jobs just like a kitchen remodel or even including a complete bathroom have a tendency to get a larger increase for less costly houses.

It is important to take into account the prices and estimated growth to your residence worth because most bigger, more costly renovation jobs may be timely and cause more unplanned costs. Focusing on small upgrades which are not tied to individual preferences is a fantastic means to better your house and keep wide appeal to buyers.

When we run repairs on houses that are offered to people, our philosophy is to search for items that the upcoming reasonable buyer might need to fix. These are usually things that affect the security, construction, and performance of the house. Listed below are typical repair things that our estimators find. Watch our comprehensive manual on specialist suggestions to boost your house worth.

7. Negotiate the best deal not the Maximum deal

It is normal to want to catch the maximum offer you get for your house, particularly if it’s greater than the asking price. But do not jump without reviewing these conditions. Most supplies include contingencies, which can be a pair of provisions in your contract which let either the purchaser or seller cancel the arrangement if these terms are not met.

Listed below are a couple of examples of how contingencies a purchaser could include within their offer:

Lending contingency

A lending contingency permits a purchaser to cancel their deal if they are not able to qualify for a mortgage. Should you take this contingency for a seller, then you put yourself at the chance of wasting time with to relist your house and begin the procedure all around.

House selling contingency

The house selling contingency is a means for a purchaser to guarantee they are going to have the profits from their current house before they buy yours. The danger is that the purchaser’s timing is not able to market their house, providing them the best to walk off.

Inspection contingency

The inspection provides an easy means for the purchaser to pay for repairs, request an extension of the closing date, or perhaps rescind their supply if the house inspection ends up any significant problems which weren’t revealed. That is a frequent reason pending sales fall through.

In hot markets, it is typical for buyers to waive contingencies as a means to “sweeten” the deal. When there is not a great deal of competition for your house, buyers might request more contingencies because they run a lesser chance of the deal not being approved. Depending on the contingencies contained, the maximum offer might not afford the most cash, particularly if the deadline for closure does not align with yours.

By way of instance, if the price falls through and you need to relist your house, you might wind up spending more cash than you’d have if you’d approved a slightly lower deal with fewer contingencies. Our website around how to pick the best deal walks throughout the procedure and how to weigh different choices as soon as an offer is to the dining desk.

Last thoughts

- To make the most of your net profits, it is very important to know local market tendencies, and also how they will affect the purchase cost you’re able to sell for. Overpricing your house can have immediate monetary consequences, and beneath pricing can make cash on the desk.

- The total sum of money you market your house for depends upon more than the listing price. Consider each the expenses related to advertising like closing expenses, seller concessions, upkeep, and home overlap prices.

- There are lots of distinct strategies to market a house that can let you sell for much more money than the standard procedure. Think about the cost savings of advertising into agents such as Sell House Fast UK versus other options like FSBO. Remember the maximum offer is not necessarily the best supply. It might consist of contingencies that affect the total amount of money you take home following your purchase.

How to Save and Invest Money

It is very obvious that money is very important in people’s lives. People should know the importance of money in the context of spending, saving and investing.

In order to understand this more, people should know the meaning of the following terms:

- Savings. It is part of your income that you won’t spend on expense but keep aside to fulfill your future need or requirements.

Consider the following when saving money:

- Make a list of your expenses and income

- Make a budget for how you want to spend on your expenses

- Do plan, how much portion of your income you want to save.

- Choose an objective of saving money and do saving accordingly.

- Keep your objectives according to priorities and save accordingly.

- Keep an eye on your budget and savings accounts.

- Investment. It is buying something so that it either appreciates in the value or provides regular income is called Investment. There are many ways to invest your money, like in equity shares, mutual funds, fixed deposits and real estates.

Consider the following when investing:

- Set or fix your amount of investment.

- Determine your objective in which you want to invest

- Fix your risk tolerance that you can take on invested capital

- Fix the time period, it can be short term or long term.

Common Mistakes People Make With Their Money

Many factors can cause personal stress and anxiety. One common cause is finances. Money is an essential commodity for survival thus becoming the most common sources of stress for many people. This is especially true for people who do not know how to handle their money or finances. In order to survive and cope up in this moving world, below are some suggestions to avoid this stress.

Here are some common mistakes people make with their money.

- Do not hope or expect too much. Many people justify their spending habits in the belief that that one day they will make lots of money and all of their financial problems will disappear. This is a real thing for many people. This is very common in the line of entrepreneurship. People who enter into business have the notion that their life will be successful as they grow their business. In some cases, business owners already spend money which they even haven’t earned yet. This is a very dangerous trap.

- Most people do not have an income problem but a spending problem. Learn to not spend more than what you are earning. Save and invest instead.

- Holding cash. Many people make the mistake of holding their money in banks or even keeping cash in their homes. Be aware that that inflation can affect your money. Holding money in banks will actually lose value every year. Saving money is not the only step in financial wellness but invest money in places that have higher returns.

The Importance of Being Financially Literate

Many people are stressed out when it comes to their finances. Some may be living beyond their means even if their income is just or not enough. Some have the habit of maximizing their credit cards and only depend on their monthly paychecks. Some may be saving for unexpected expenses. The question is, can we be financially secure even if we do not have a lot of money?

Understanding Financial Literacy. It all starts with this basic terms:

- Income. This is the money that comes in. It is the money we receive from work or investments. It’s important to ask the question “How do you make money?” Set goals in achieving your dreams. Create and practice good values in the job market. This can lead you far.

- Expenses. This is the money going out. This is money that you pay for goods and services. Always ask the question, “How do you spend your money?” It is important to construct your own financial budget and how you would execute it.

- Assets. These are things we own. This includes money or property a person owns that has a value. The road to building assets starts with saving. Make it a habit to save.

- Liability. This is a debt you owe to any person or a business. A lot of people get into financial trouble by constantly spending more than they earn. Credit is readily available today, this may be good and may be bad. Good because it can enhance your ability to undertake attractive investments such as a home or even your education. Spend in assets when using credit rather than buying something that will soon disappear such as food.

Investment or tangible assets?

In times of crisis in particular, many investors are afraid of increasing inflation. Should you, therefore, shift your assets from monetary assets to tangible assets?

Inflation is the periodically recurring evidence of the fact that printed paper is printed paper. It has also been historically proven time and again those permanent assets were only built up with material assets.

But what is the difference between real and monetary values?

As the name suggests, tangible assets are assets that exist in physical form. This includes, for example, real estate, gold, silver and stocks, but also investment funds that invest in real assets or ship investments.

In contrast, monetary values represent a form of investment that is based on our paper currency. Typical monetary values are, for example, cash, savings books, fixed-term deposits, building society contracts as well as capital-forming life insurances or pension insurances.

Monetary values can become problematic when the amount of paper money in circulation is no longer covered by gold reserves. In this case, the money supply and national debt continue to grow. It is now known from history that a paper money system has rarely survived for more than two or three generations.

Real assets are more inflation-proof

Sooner or later there will be a devaluation. This can happen slowly or suddenly. In both cases, pure investments lose their value. Material goods such as real estate, land or gold will be physically preserved and will increase in value again after the crisis has been overcome.

If you are planning an individual investment strategy, you should take this into account. As a recommendation, monetary assets are primarily suitable for securing everyday life. You can park a few salaries on a savings account or as daily money to pay for unforeseen repairs such as a broken washing machine.

And if you have invested in cryptocurrency, you can check the bitcoin mixing site to help you guard your identity and privacy and identity.

In the medium to long term, however, you should invest your capital in real assets in order to secure your purchasing power and not to lose all of your capital in the event of creeping or sudden inflation.

Financial Assets

Financial assets of a company may include cash or money. It also includes other financial instruments. Financial instruments, other than hedging instruments are classified into the following categories:

- Financial Assets through a fair value through profit or loss

- Loans and Receivables

- Held to maturity investments

- Available-for-sale financial Assets

- Financial assets are assigned to different categories by the company’s management on initial recognition. This solely depends on the purpose for which the investments were acquired.

Explaining Financial Assets

A financial instrument may be classified also as a debt., otherwise as an equity if it has a contractual obligation to:

- Deliver Cash or another entity

- Exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavorable to the Company.

Knowing The Stock Market And How Do I Invest in It?

The stock market is a place where investors are able to participate in an existing business by buying a share of ownership of the business.

Why should I put my money on stocks?

Investing in stocks is one of the fastest vehicles to fast forward the gains of your investment through capital appreciation. This means increasing the value of your investment through the rising income of the companies. By choosing the right companies o invest in, you can partake in the earnings of companies that you part-own.

Earning the stock market includes risk, but managing those risks through careful planning and research will help you take advantage of capital appreciation and partaking in the company’s stocks and cash dividends.

Being Financially Free

There is a saying that money can’t buy happiness but it put your worries behind and give you peace of mind! It is a fact that a person who is financially free is also financially stable. One is financially free if he does not struggle financially.

Financial freedom means to say that one has enough savings, investments and disposable income to make life desirable for both the person and his or her family. When we are financially free, we are able to grow our savings that would secure us for the future.

Here are some good habits we can practice to help us reach financial Freedom:

- Set a GOAL in life.

- Learn to save and budget.

- Pay credit cards in full

- Look for good investments

- Always be watchful of all your credits.

- Learn the skill of Negotiating.

- Don’t stop learning

- Always live below your means

- Value and make your health a priority.

FULL-SERVICE INVESTMENT BROKERS

FULL-SERVICE INVESTMENT BROKERS